The Industrial-Scale Pig Butchering Problem Exchanges Can’t Ignore

Pig butchering scams are no longer niche or isolated incidents—they’ve evolved into an industrial, AI-driven, multi-billion-dollar criminal enterprise targeting cryptocurrency users worldwide.

Despite how well the tactics are understood, the trend isn’t slowing; it’s accelerating.

The human toll is immense and well-reported. But the financial toll to custodians is underreported and often punitive.

Continuing on the current path is unsustainable for users, exchanges, and the crypto industry overall.

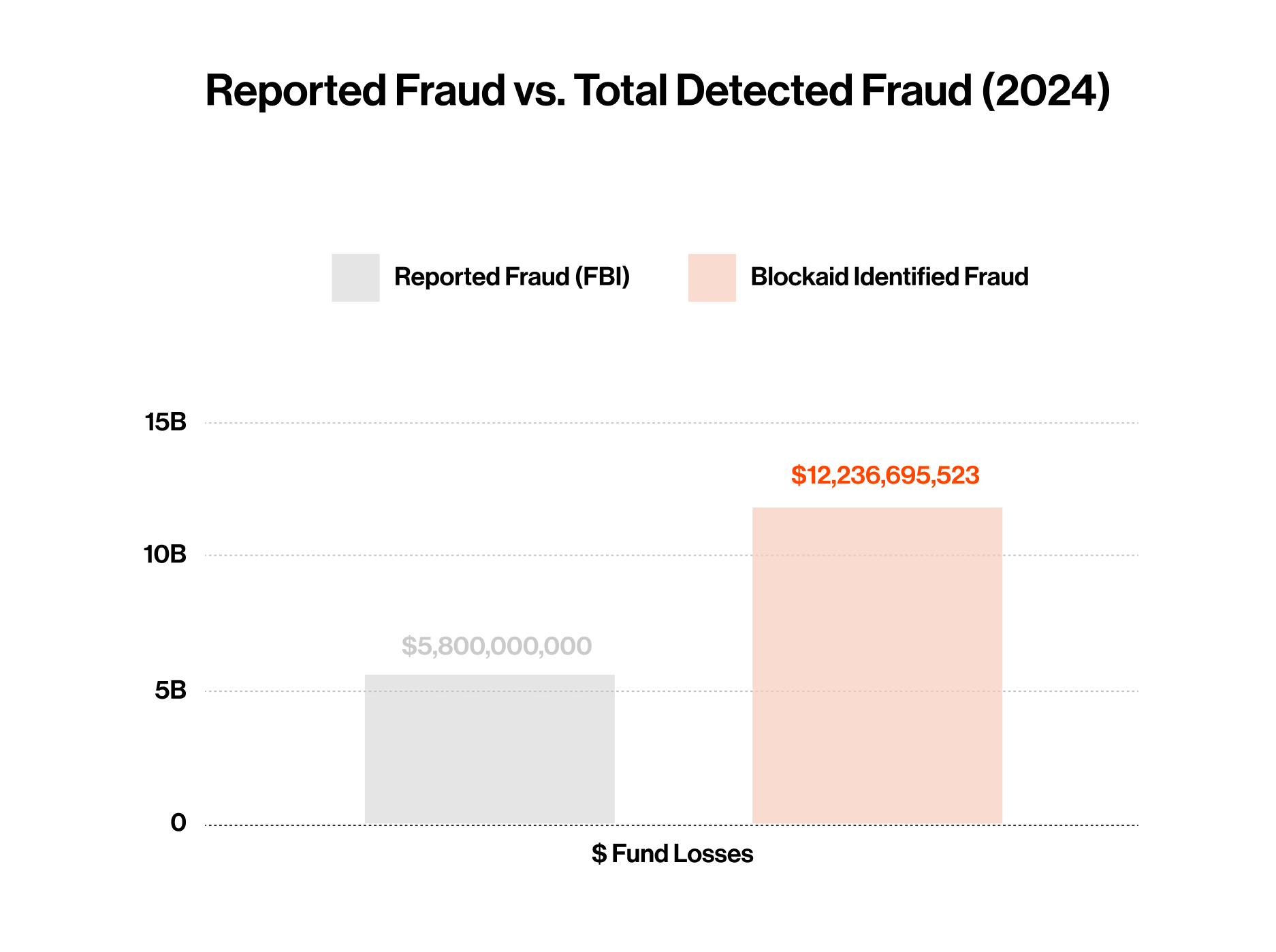

Data doesn’t lie. It’s just measured incorrectly.

In 2024, $12.24B was lost across custodial exchanges*. And yet, in its 2024 Internet Crime Report, the FBI only shows $5.8 billion in losses from cryptocurrency investment schemes.

*Blockaid-identified fraud represents evidence-backed transactions identified by Blockaid’s threat researchers and agentic scam site testing. Note: p ≤ 0.05

Why a gap? Fraud accounting depends on victim reports

Following a 25-year legacy at the FBI’s Internet Complaint Center (IC3) and TradFi’s traditional approach to fraud, victims need to report incidents for it to be treated as fraud.

This hands-off approach makes sense for victims of direct types of fraud, including personal data theft, extortion, or harassment. But it does not work for cryptocurrency investment scams, in which most victims—roughly 8 out of 10—are unaware they are being scammed, and do not file a report.

Regulators around the world are beginning to raise questions about the custodian’s role in addressing the challenge strictly ex post facto.

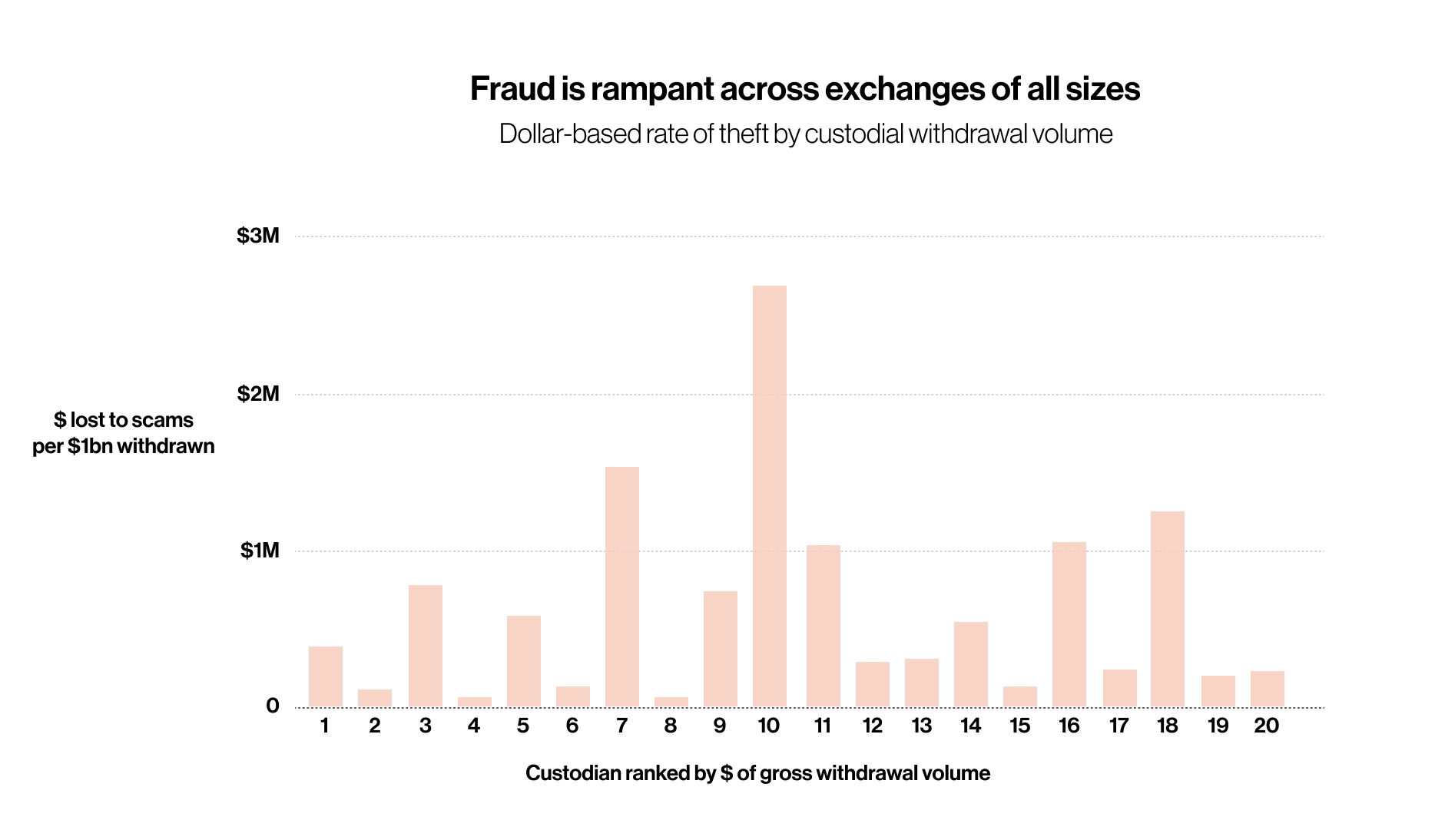

All exchanges are at risk

When evaluating the top 20 CEXs by gross onchain withdrawal volume over the past 12 months, it becomes clear that theft is widespread. Normalizing exchanges on a theft per $1bn withdrawn metric—but ranking by gross withdrawal volume—shows no relationship between prevalence of theft and scale of withdrawal activity.

Scammers—not unlike viruses—infect Exchange hosts that have not been immunized against modern fraud operations.

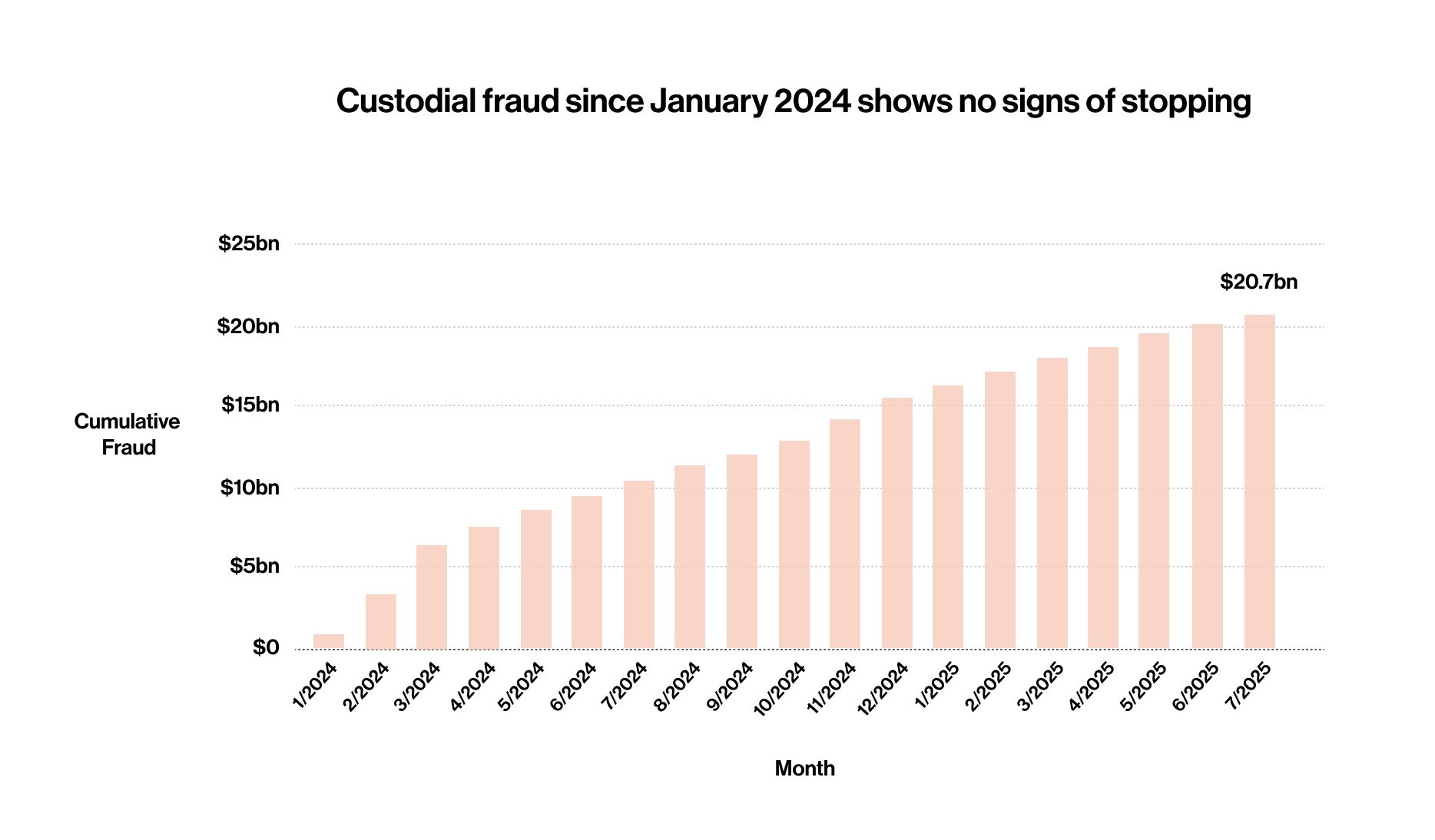

The problem is more pressing than ever before

Crypto’s “Instagram moment” is within reach, but the total costs of fraud, negative attention from government regulators, and revenue risks must be mitigated for custodians to scale their businesses further.

The total cost of fraud is becoming difficult to tolerate

Fraud data captured by Blockaid from high-certainty scams (p ≤ 0.05) shows a scale of fraud more staggering than government-agency data and a trend that continues unabated.

The size of the problem is scary, but what is scarier is the growth despite sizable fraud detection investments made by custodians over this time period.

*Across major chains, since January 2024, $21bn in stolen funds have been siphoned from global Centralized Exchanges (CEXs).

Scammers are using AI and fraud-as-a-service infrastructure to scale their operations and phony investment applications, while custodians continue to lean on the solutions of yesteryear.

This is exactly what the metaphor “bringing a knife to a gunfight” intends to convey and discourage.

Scaling, AI-driven fraud generates more user incident reports requiring higher levels of Trust & Safety, longer, more complex investigations, and additional headcount.

More case managers, data scientists, and developers of self-managed security tooling will be needed, eroding the company’s profit model.

To make matters worse, TradFi banks, a critical fiat onramp and lifeblood for CEXs, have notified crypto custodians that they are blocking customers from transferring funds to exchanges due to intolerable fraud incident levels and TradFi chargeback requests.

Expansion of these tactics would be a death knell for the industry.

Revenue is “at risk” more than ever before

Two customer retention risks are putting crypto-native custodians on notice:

- Fintechs launching exchanges are making market dynamics more competitive. While traditional brands may lack appeal with crypto-enthusiasts, they hold weight with the next wave of users that can provide sustainable growth to existing CEXs. Furthermore, their prior experience in fraud data science, detection, and operations gives them a particular advantage on the specific issue of user trust and safety.

- “Silent user churn” becomes palpable at scale. When only 2 out of 10 scammed users report an incident, many of the remaining 8 simply stop using the service involved in the encounter. It’s necessary for product managers and data teams to collaborate more closely with fraud to measure the true retention impact of scams beyond attrition due to false positives.

Why the status quo must change

Pig butchering is no longer a fringe threat—it’s a systemic risk to every exchange, regardless of size or market share. Awareness is the first line of defense. Custodians must recognize the scale of the problem and understand what a new solution must offer to be worthy of investment.

Prevent Crypto Fraud with Blockaid

Blockaid’s Crypto Fraud Prevention (CFP) solution moves custodians left of boom—detecting and stopping scams in real time, directly in the custodial app UX.

The status quo must change for exchanges serious about fighting pig butchering scams and bleeding user trust.

Blockaid is securing the biggest companies operating onchain

Get in touch to learn how Blockaid helps teams secure their infrastructure, operations, and users.