Left of Boom: How Blockaid Prevents Pig Butchering Crypto Fraud Scams

The fastest-growing scams in crypto don’t hack systems—they hack people and evade traditional detection.

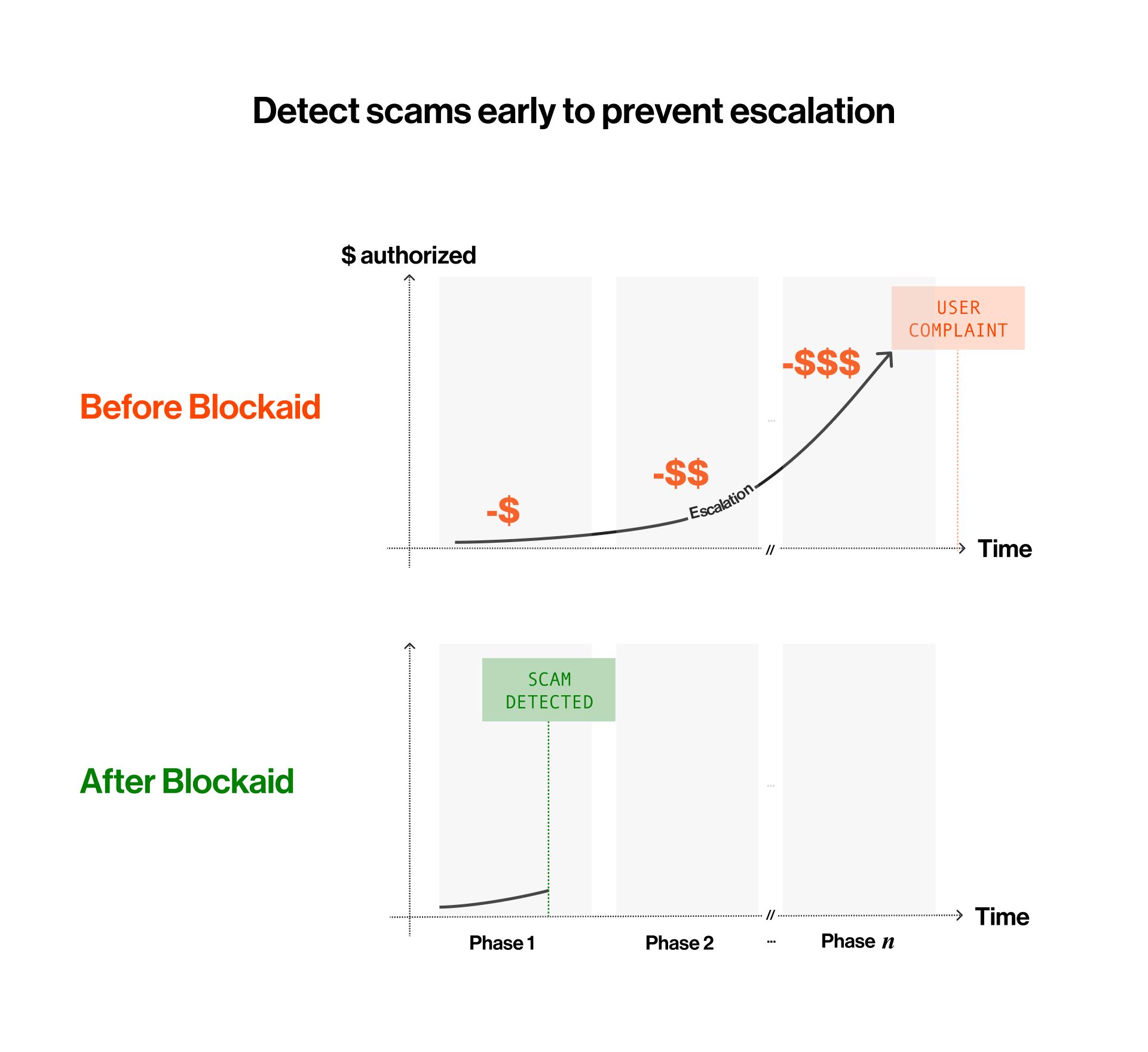

Pig butchering, fake support chats, romance scams, and money muling are campaigns that unfold over days and weeks with dozens of victims slowly transferring increasingly larger payments to scammers.

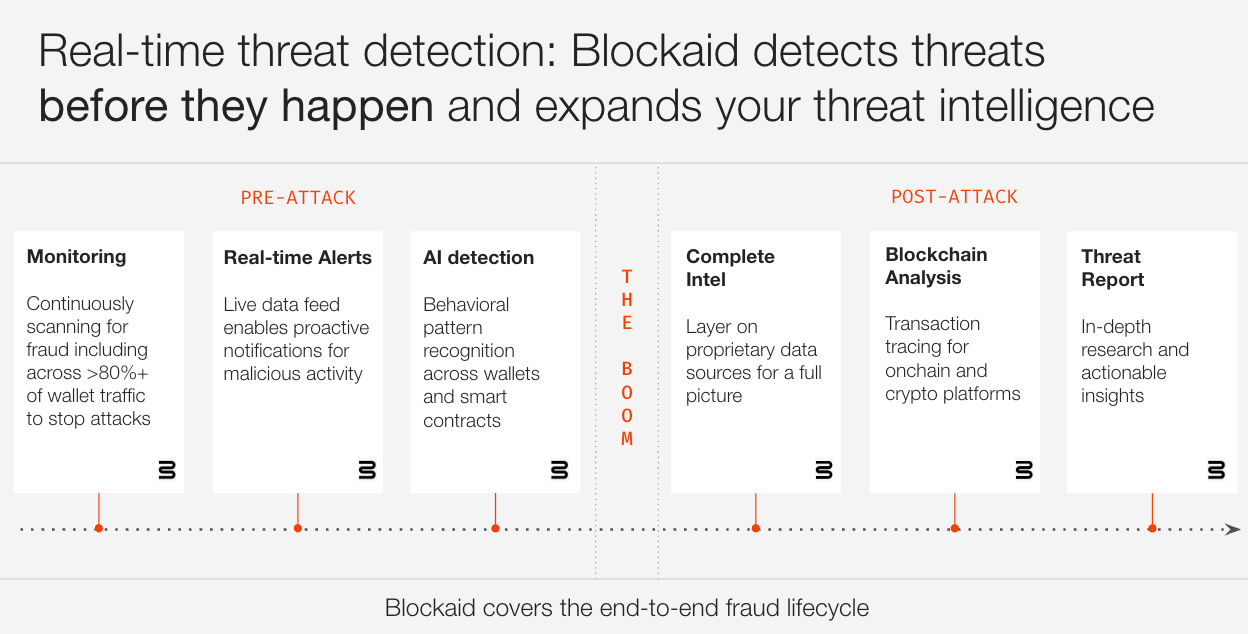

Legacy fraud tools built to catch stolen keys or high-velocity transactions are blind to the longer timeline of these scams. By the time fraud teams begin an investigation, funds are already unrecoverable.

This changes today.

Blockaid’s Crypto Fraud Prevention solution

Blockaid’s Crypto Fraud Prevention (CFP) solution is different. It embeds detection directly into the custodian’s user flows, shifting fraud operations from post-incident investigation to event-driven prevention.

CFP doesn’t wait for a victim report or compliance flag. It recognizes the patterns scammers can’t hide—across transactions, accounts, and offchain infrastructure.

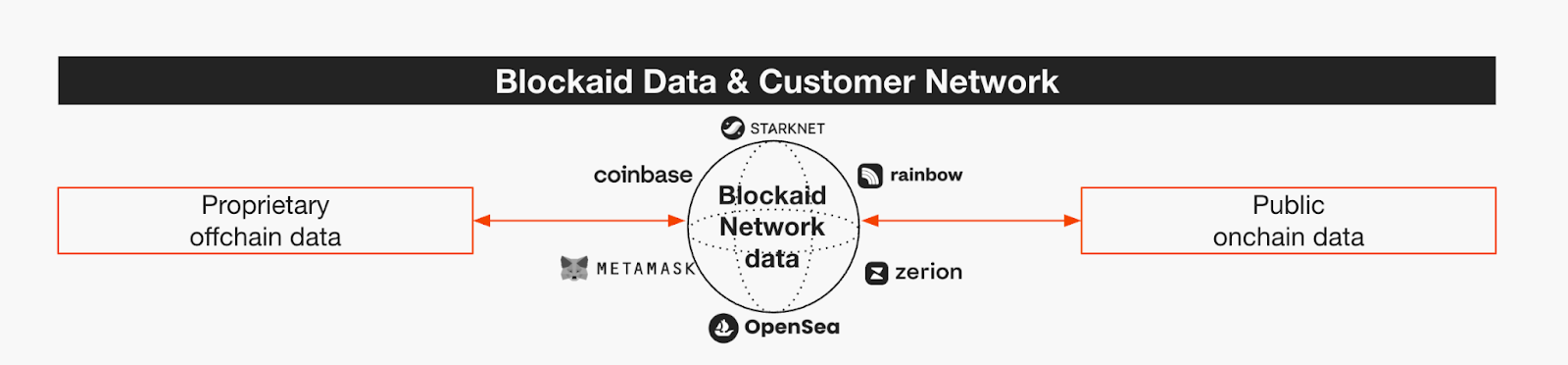

Powered by Blockaid’s intelligent threat engine, CFP is trained on 3TB of security data every day, including onchain heuristics, offchain social channels and websites, and signals from Blockaid’s customer network.

REST APIs and a powerful UI flag malicious activity in real time, even when a destination address is new and the transaction aligns with the user’s profile.

Every Blockaid detection comes with a clear, evidence-backed risk verdict, so fraud and product teams can act decisively—reducing losses without introducing unnecessary friction for users.

How Blockaid’s Crypto Fraud Prevention works

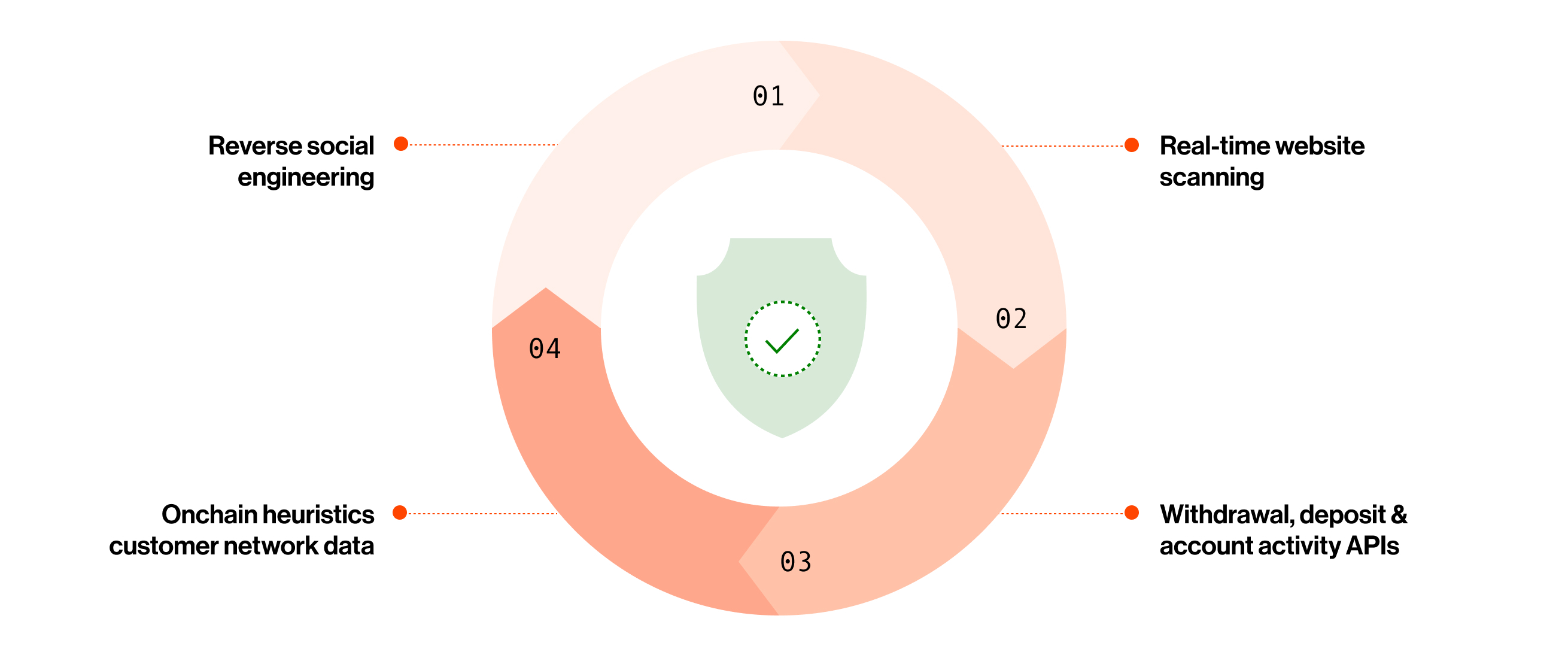

CFP provides fraud and product teams with a set of REST APIs, risk verdicts, and an investigation UI.

Under the hood, there’s an integrated intelligence and enforcement engine designed to detect fraud signals early and act before funds leave the user’s account or the exchange.

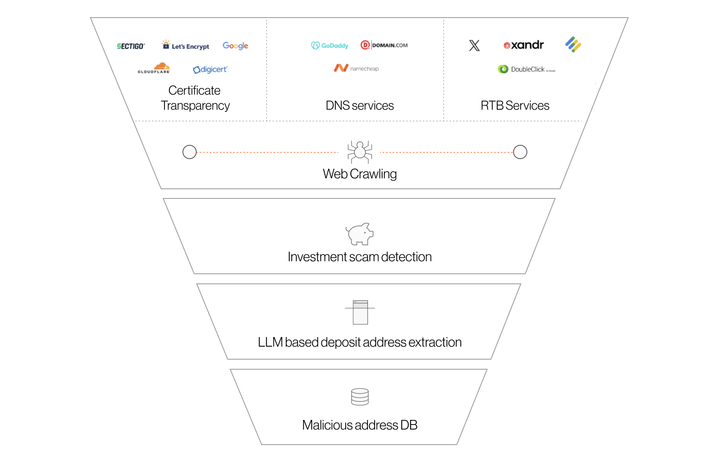

1. Continuous intelligence ingestion

Blockaid’s threat engine is trained on 3TB+ of daily security data, including:

- Reverse social engineering: Our researchers use AI agents to engage scammers directly through social channels to identify active campaigns, scam websites, and associated wallets.

- Web2 scam address extraction: Monitoring DNS registrations, ad networks, and content platforms to capture scam-linked wallet addresses.

- Onchain heuristics: Analyzing behavioral patterns and address exposure, helping reveal malicious actors multiple hops away.

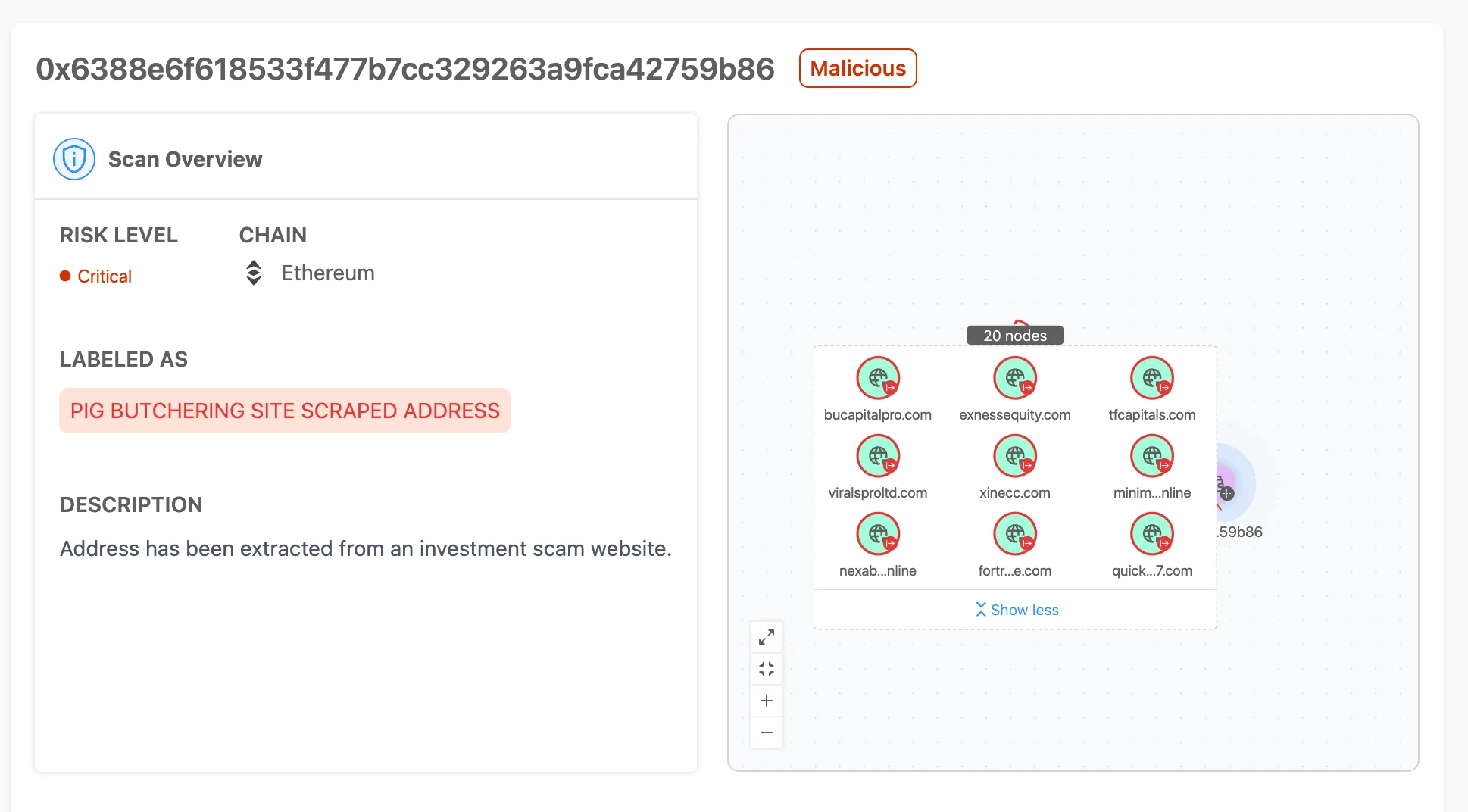

.png)

*An address detected by Blockaid for association with other suspicious onchain addresses and offchain scam sites, indicating fraud-as-a-service with multiple custodian user impacts.

- Network effects from our customer base: Malicious addresses identified with one customer strengthen detection for all, while benign activity patterns from Blockaid’s extensive crypto interface customer base significantly lowers Blockaid’s false positive rate.

2. Real-time decisioning through APIs: Exchanges integrate Blockaid’s Withdrawal, Deposit, Reports, and Account Enrichment APIs directly into user transaction flows. Responses are provided in <200ms and combine live account activity with onchain and offchain threat intelligence.

3. Risk-based enforcement: All findings are classified into one of four risk levels—Severe, High-Risk, Medium, Low—each with context and evidence behind the decision. This enables targeted interventions by product teams, such as transfer blocks for confirmed scams, friction or warnings for suspicious cases, and seamless passage for benign transactions.

4. Linked investigation and case closure: For incidents that require deeper review, the investigation graph maps transactions across onchain and offchain surfaces, links them to scam infrastructure, and identifies other impacted accounts—accelerating MTTI and building a complete audit trail for reporting purposes.

What Blockaid’s Crypto Fraud Prevention protects against

Blockaid’s Crypto Fraud Prevention provides a hard enforcement layer for the fraud patterns traditional exchange tooling can’t catch—closing the gap between when a scam begins and when it’s stopped.

Addresses with no onchain history

Many scams funnel funds to wallets that have never transacted before, making blacklist checks useless.

Blockaid’s Crypto Fraud Prevention detects suspicious activity based on behavioral and infrastructure patterns—like deposit timing, gas funding cycles, and cross-account linkages—so it can flag the scam the first time it happens.

Social engineering that passes static checks

Because victims authorize the transactions, they sail through most velocity, anomaly, or credential-theft checks. CFP correlates onchain and offchain data—including reverse social engineering—to surface the latest fraud campaigns before funds are lost.

Money muling

Money laundering doesn’t appear as one large deposit—it’s often a series of smaller, timed inflows designed to avoid detection.

Blockaid’s Crypto Fraud Prevention identifies these laundering flows, even when they’re routed through multiple new user accounts or split across chains.

Wasted company time and resources

Without unified tooling, analysts and security teams waste hours stitching together onchain records, scam reports, and account data while product teams struggle to apply user friction without driving regretful churn.

CFP brings together APIs, discrete decisioning tools, and a rich investigation user interface to reduce time to detection, investigatory staffing levels, and aggregate levels of fraud.

How exchanges use Blockaid’s Crypto Fraud Prevention

Exchanges deploy Blockaid’s Crypto Fraud Prevention as a stack—APIs for real-time detection, decisioning tools for automated enforcement, and an investigation platform for closing cases fast.

Each layer integrates directly into existing workflows, so teams can stop scams without slowing down the rest of the business.

Real-time detection through APIs

Exchanges plug Blockaid’s low-latency REST APIs—Withdrawal, Deposit, Reports, and Account Enrichment—into their transaction flows.

Every action is analyzed in under 200ms against Blockaid’s 3TB-a-day intelligence network, combining onchain heuristics, offchain scam intelligence, and benign behavior patterns from across our customer base.

This ensures fraud is detected before it clears, even when targeting a brand-new wallet.

Automated enforcement with decisioning tools

API responses return a severity verdict—Malicious, High-Risk, Warning or Benign—backed by explainable evidence.

Exchanges map these verdicts to enforcement policies: instantly blocking confirmed scams, adding friction for high-risk cases, or letting safe transactions pass without disruption.

This allows precision action at scale without guesswork or blanket blocking.

Deeper investigations with the platform

When a case needs more than an automated decision, analysts open the investigation UI to see the full picture—onchain transactions, related scam infrastructure, laundering paths, and connected accounts in the same campaign.

This accelerates case closure, improves regulatory reporting, and feeds intelligence back into prevention rules.

Continuous improvement from network effects

Because every integration strengthens the network, scams identified by one exchange are instantly factored into detections for all others.

The more data that flows through Blockaid, the faster and more accurate verdicts become.

For exchanges, this means moving fraud prevention “left of boom”—catching scams before funds leave, automating enforcement for speed, and closing investigations with confidence.

See it in action

The most damaging scams in crypto don’t wait for you to catch up—they’re executed before they even look suspicious to existing tooling.

Blockaid’s Crypto Fraud Prevention gives exchanges the real-time detection needed to act with precision, intervene before the scam escalates, and close the loop on every case.

Request a demo to see how you can move your fraud operation from reactive cleanup to proactive control.

Blockaid is securing the biggest companies operating onchain

Get in touch to learn how Blockaid helps teams secure their infrastructure, operations, and users.