What the Paxos Minting Error Exposed About DeFi Risk

For 22 minutes, PYUSD wasn’t GENIUS standard

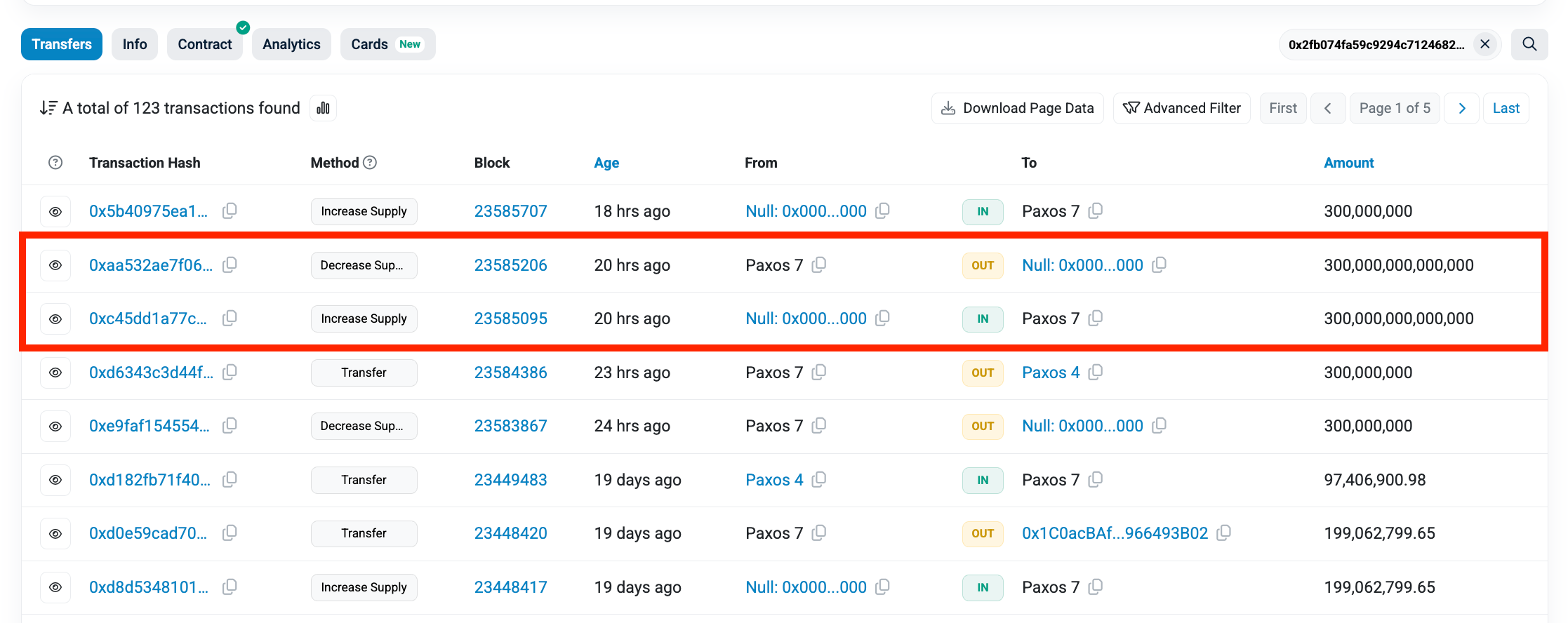

Yesterday, Paxos, one of the most trusted and regulated players in crypto, accidentally minted $300 trillion PYUSD. For a brief period, the total supply onchain was greater than the world’s GDP.

It was a single administrative error that exposed how easily one anomaly can affect DeFi core systems including stablecoin issuance, collateral ratios, oracles, and liquidation logic across the ecosystem.

The risk beneath the surface

Paxos, a regulated trust company under NYDFS oversight, bridges traditional finance and blockchain by converting fiat reserves into tokenized assets that move on chain.

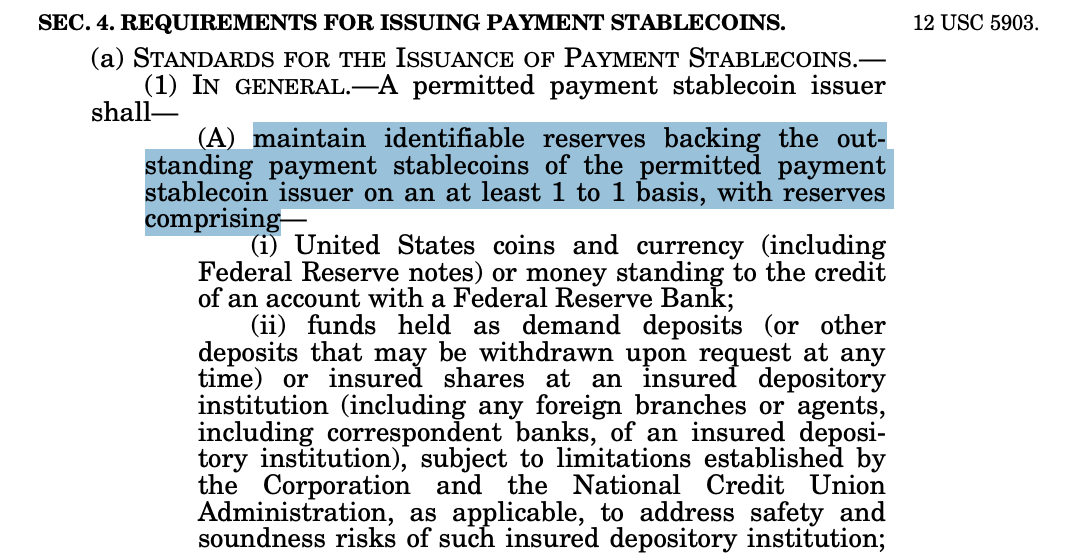

The GENIUS Act requires licensed stablecoin issuers to back each token 1:1 with highly liquid and safe reserves, primarily U.S. dollars and short-term Treasuries, held within a regulated framework.

While the law does not yet map directly onto smart contract functions, the entity controlling the mint key is responsible for ensuring compliance with the reserve policy.

On October 15, that compliance responsibility failed.

The failure was not in the smart contract. It was in the control layer that decides which transactions get signed and sent.

The layer Cosigner secures

That is the layer Blockaid’s Cosigner is built to protect. It sits between intent and execution.

Cosigner connects to an issuer’s signing infrastructure (multisig or MPC) and acts as an independent validation layer for every outbound transaction.

For a stablecoin issuer, that means no mint, burn, or supply adjustment reaches mainnet until it passes Cosigner’s policy and simulation checks.

Cosigner ensures that:

- Only approved functions, from authorized processes, can execute.

- Hard caps prevent any mint or burn from exceeding predefined thresholds.

- Every transaction runs offchain first to simulate how balances and supply would change.

- Transactions cannot broadcast without Cosigner’s explicit approval.

- Any manual override is logged, reviewable, and fully auditable.

Cosigner turns what was once a trust-based assumption into a technical guarantee.

When issuers fail, protocols absorb the risk

For lending protocols, stablecoins are the backbone of collateral and liquidity.

When an issuer fails, it distorts collateral ratios, disrupts oracles, and triggers forced liquidations.

Blockaid’s Onchain Monitoring closes that visibility gap by turning raw blockchain data into actionable intelligence.

It detects and contains exposure before anomalies cascade through the system.

Capabilities include:

- Supply anomaly detection: Flags abnormal mints in real time so markets can pause before exposure spreads.

- Oracle correlation: Detects mismatches between token supply and price feeds.

- Dependency mapping: Reveals which pools and vaults hold the affected asset.

- Automated circuit breakers: Pauses markets or disables collateral instantly.

- Shared intelligence: Propagates alerts across protocols to contain contagion.

With real-time visibility and controls in place, protocols move from reaction to prevention, containing risk before it spreads across the system.

The takeaway

Cybersecurity in stablecoin issuance is no longer just good practice. It is becoming a regulatory expectation.

Issuers will soon need to prove that they have taken every possible measure to secure the future of digital dollars.

Blockaid is securing the biggest companies operating onchain

Get in touch to learn how Blockaid helps teams secure their infrastructure, operations, and users.